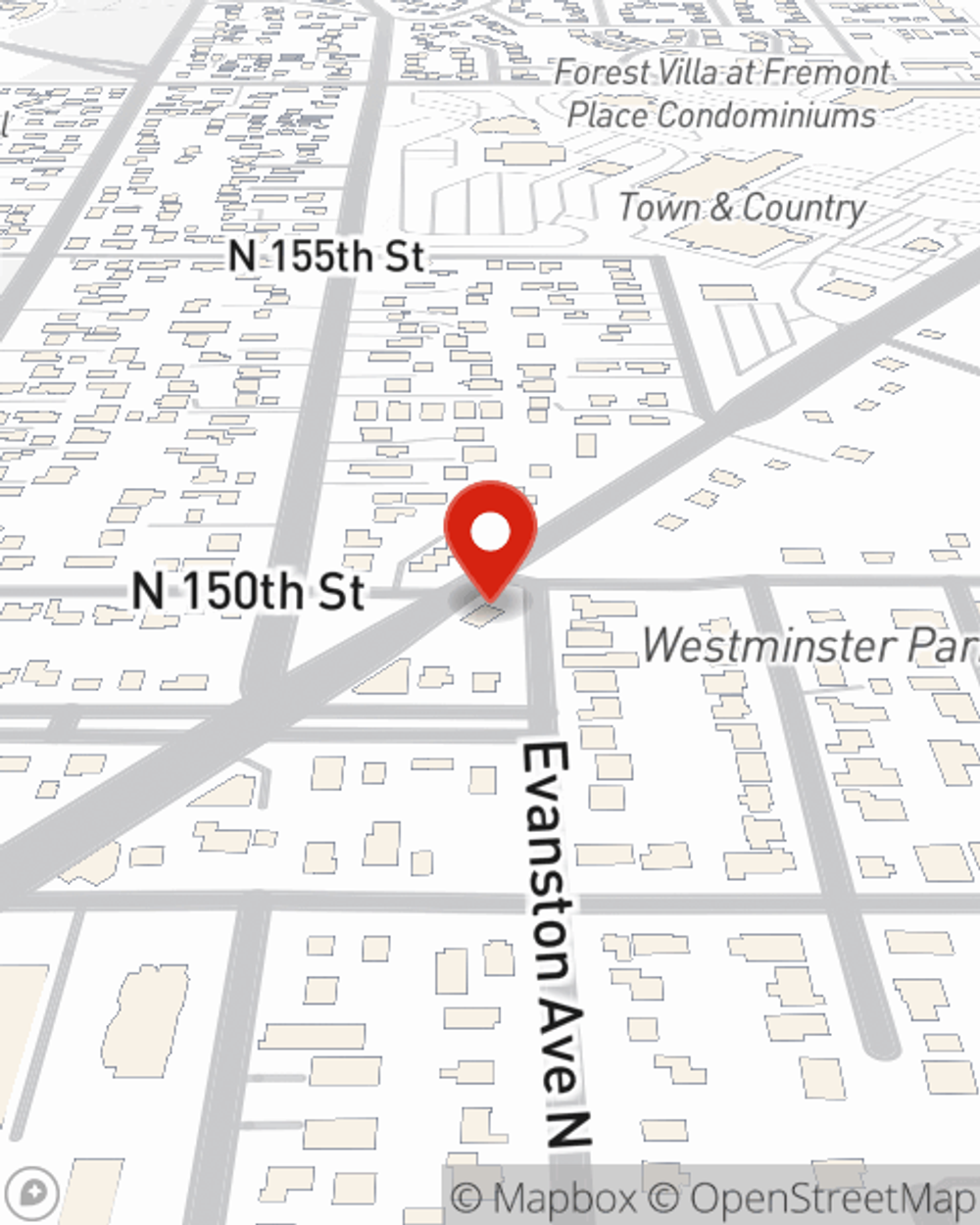

Business Insurance in and around Shoreline

Looking for small business insurance coverage?

Cover all the bases for your small business

- Shoreline

- Seattle

- Edmonds

- Bothell

- Lynnwood

- Kenmore

- Lake Forest Park

- Woodway

- Mill Creek

- North Creek

- Redmond

Help Prepare Your Business For The Unexpected.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Erin Ison can relate to the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to investigate.

Looking for small business insurance coverage?

Cover all the bases for your small business

Cover Your Business Assets

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a dentist or an HVAC contractor or you own a candy store or a pottery shop. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Erin Ison. Erin Ison is the agent who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

At State Farm agent Erin Ison's office, it's our business to help insure yours. Visit our exceptional team to get started today!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Erin Ison

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.